michigan.gov property tax estimator

You can now calculate an estimate of your property taxes using the current tax rates. Michigan has one of the.

Florida Property Tax H R Block

Use this estimator tool to determine your summer winter and yearly tax rates and amounts.

. After two months 5 of the unpaid tax amount is assessed each month. 313 343-2435 Water Billing. Get the latest updates and resources.

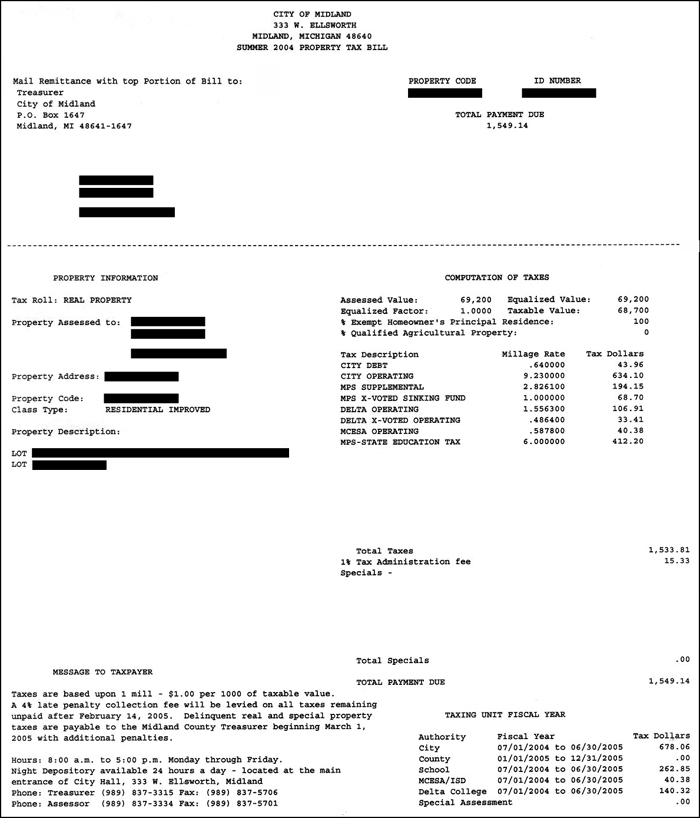

Business Tax Forms Instructions. The maximum late penalty is equal to 25 of the. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value. Worksheets 4 Recipients of FIPMDHHS 5. Tax Tools Estimators and Calculators.

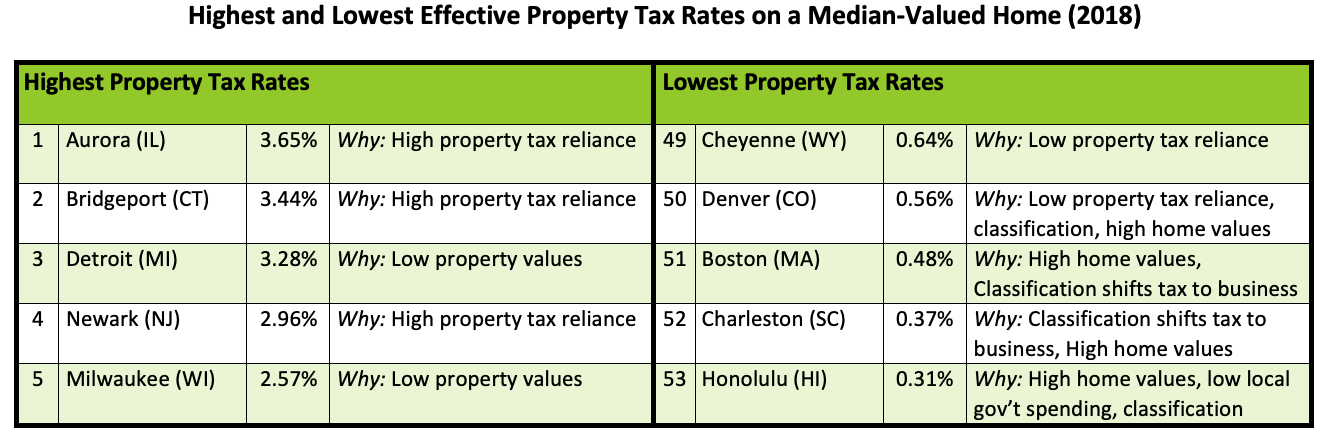

By accessing and using this computer system you are consenting to system monitoring for law enforcement and other. Office of Inspector General. The city has a high tax because it lacks the authority to levy a local-option sales tax has low home values and spends a lot of money on local government.

The most common rate used by 20 of the 24 cities with a local income tax is 1 for residents and 05 for non-residents. The median property tax on a 12400000 house is 200880 in MichiganThe median property tax on a 12400000 house is 130200 in the United States. Simply enter the SEV for future owners or the Taxable Value.

Welcome to the NEW eServices portal. 2021 Retirement Pension Estimator. Tax amount varies by county.

313 343-2785 Tax Questions. This Treasury portal offers one place for taxpayers to manage all their Individual Income Tax needs. Counties in Michigan collect an average of.

Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. Penalty is 5 of the total unpaid tax due for the first two months. 2022 Retirement Pension Benefits Chart.

Office of the Auditor General. Follow this link for information regarding the collection of. Simply enter the SEV for future owners or the Taxable Value.

Homestead Property Tax Credit. This system contains US. The average effective property tax rate in Macomb County is 168.

School District 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills. Worksheet 2 Tier 3 Michigan Standard Deduction Estimator. This largely suburban county northeast of Detroit has property tax rates that rank fairly high nationally.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Novitke Municipal Center 20025 Mack Plaza Grosse Pointe Woods MI 48236. 2022 Retirement Pension Estimator.

Property Tax collapsed link. Enter the Taxable Value of your property and select the school district from the options. Reports and Legal Individual Income Tax New Developments for Tax Year 2021 Income Tax Self-Service New Developments for Tax Year 2021 Income Tax Self.

Detroit has the highest city rate at 24 for residents and 12 for. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. Application for State Real Estate Transfer Tax SRETT Refund.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

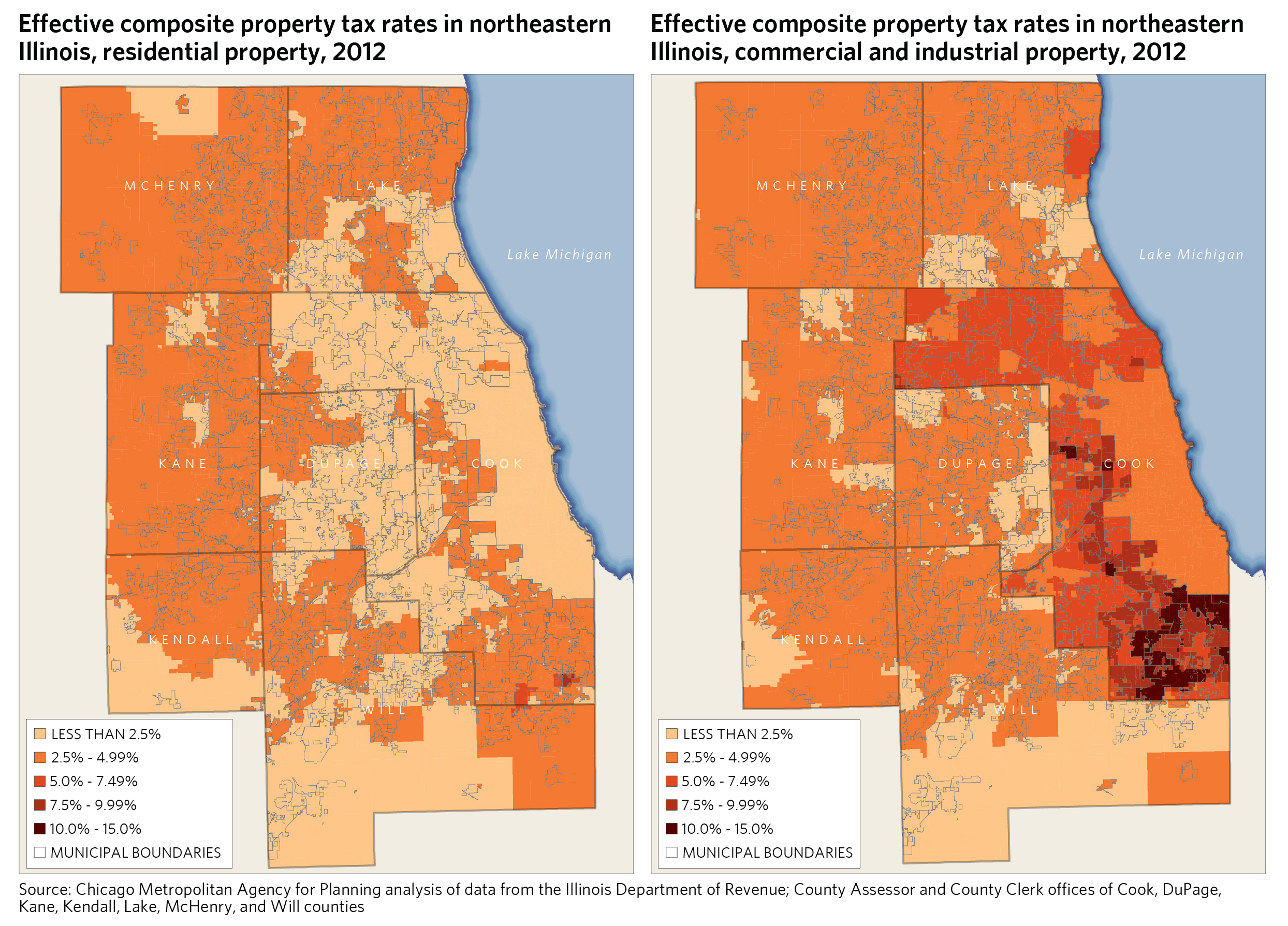

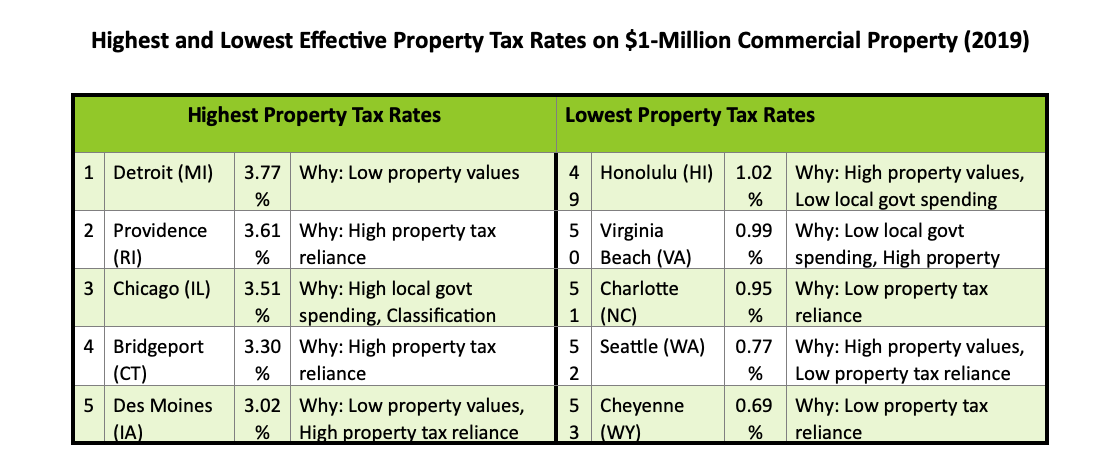

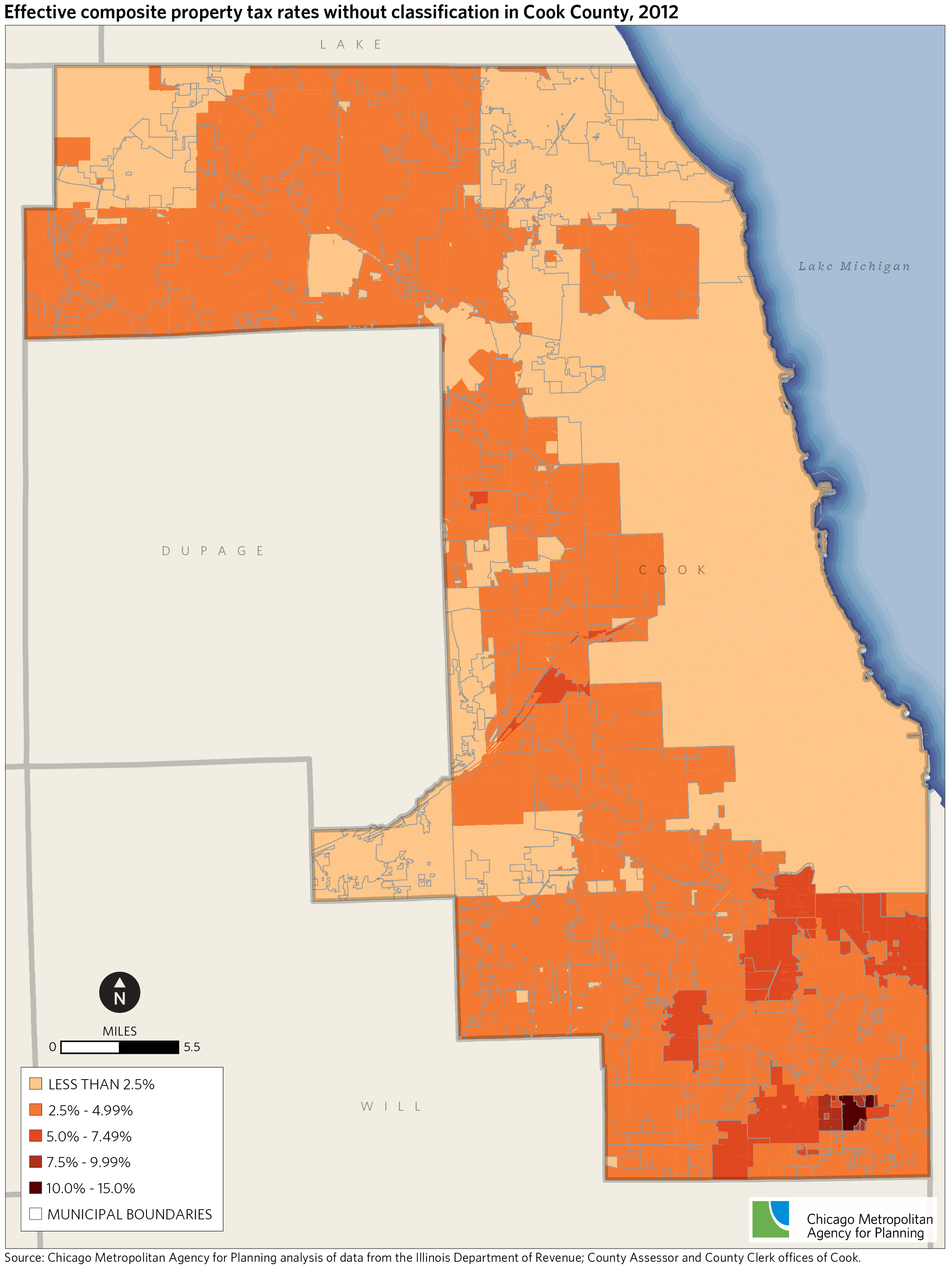

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Tangible Personal Property State Tangible Personal Property Taxes

Taxes Pittsfield Charter Township Mi Official Website

Michigan Property Tax H R Block

Redford Township Government Departments Assessor About The Assessing Office

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Michigan Department Of Treasury Taxes

Winter Tax Bill Example Macomb Mi

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Taxes And Usda Programs Farmers Gov

Fifty State Study Details Growing Property Tax Inequities From Assessment Limits Lincoln Institute Of Land Policy

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

Tangible Personal Property State Tangible Personal Property Taxes

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Property Tax Archives Michigan Property Tax Law

How Do State And Local Property Taxes Work Tax Policy Center

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center