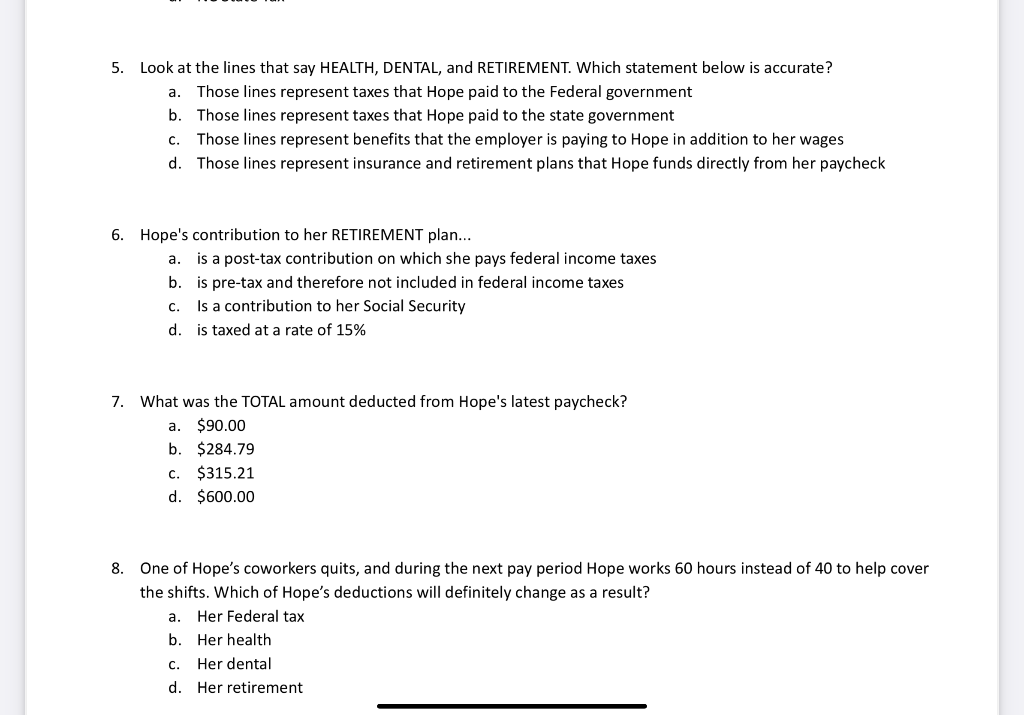

how much federal taxes deducted from paycheck nc

Single filers who earn more than this amount have. If the taxpayer earned no more than that no taxes are due.

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Therefore it will deduct only the state income tax from your paycheck.

. Single filers who have less than 9700 taxable income are subject to a 10 income tax rate the minimum bracket. North Carolinas income tax has a single flat tax rate for all income. Use this tool to.

How Your Paycheck Works. A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance.

For 2022 its a flat 499. Federal income tax and FICA tax. The income tax is a flat rate of.

Learn how marginal tax brackets work. Your average tax rate is 959 and your marginal tax rate is 22. See how your refund take-home pay or tax due are affected by withholding amount.

If you make 56500 a year living in the region of North Carolina USA you will be taxed 7819. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent. This marginal tax rate means.

This situation is only slightly different for other taxpayer. FICA taxes are commonly called the payroll tax. For a single adult under 65 the threshold limit is 12000.

Winners in other locations could pay as much as 1075 in state or local taxes according to USA Mega. The amount of income tax your employer withholds from your. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

The winneror winnerswill owe 24 to the IRS in federal taxes. The state of North Carolina offers a standard deduction for taxpayers. For employees withholding is the amount of federal income tax withheld from your paycheck.

It is a flat rate that is unchanged. 13 hours agoStandard deductions for your 2022 and 2023 taxes are higher after the Internal Revenue Service raised them to account for inflation. However they dont include all taxes related to payroll.

That means the dollar amount taxpayers. In North Carolina The state income tax in North Carolina is 525. The 2021 standard deduction allows taxpayers to reduce their taxable income by 10750 for single filers 21500.

FICA taxes consist of Social Security and Medicare taxes. The North Carolina tax tables will help you withhold the correct amount. For North Carolina tax purposes a taxpayer is allowed a deduction for the repayment to the extent the repayment is not deducted in arriving at the taxpayers adjusted gross income in the current.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. North Carolina Income Tax Calculator. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

The employer withholds this tax from the employees paycheck. Any wages above 147000 are exempt from. Deductions for the employers benefit are limited as follows.

Skip to main content. Your employee should provide you with an Employees Withholding Allowance Certificate. 15 rows The median household income is 52752 2017.

Estimate your federal income tax withholding. 17 rows The act went into full effect in 2014 but before then North Carolina had a three-bracket. North Carolina levies state income tax at the flat rate of 525 regardless of income level and filing status.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

North Carolina Audit Notice Sample 2

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

North Carolina S Small Business Scorecard August 2019

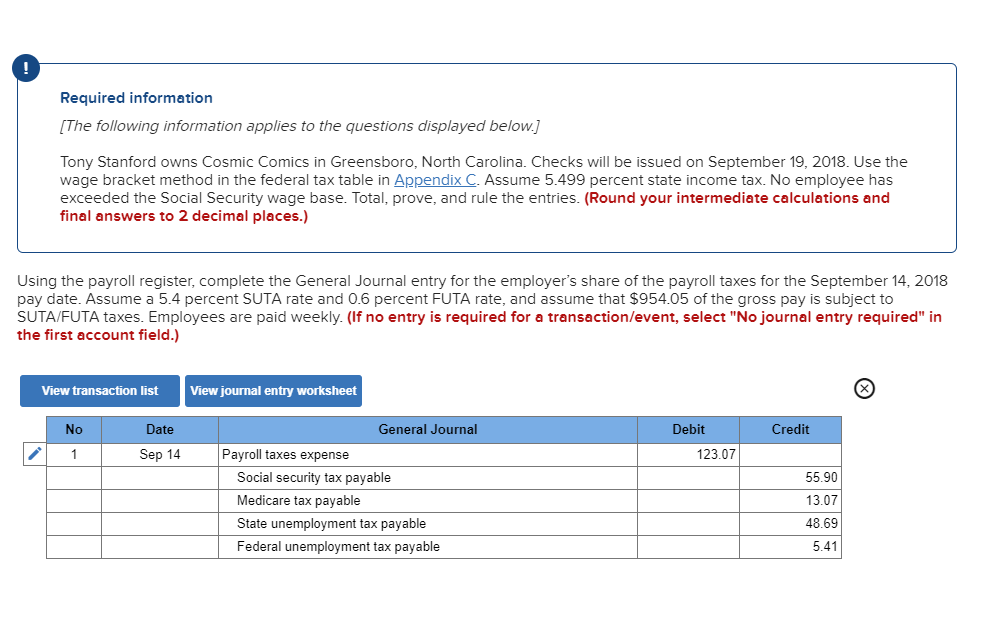

Solved Edit No Payroll Registers Were Provided I Chegg Com

North Carolina Paycheck Calculator Smartasset

Taxable Wage Definition For Social Security Taxes

Unemployment Insurance Cares Act Patterson Harkavy Llp

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Payroll Software Solution For North Carolina Small Business

W 4 Form What It Is How To Fill It Out Nerdwallet

State Individual Income Tax Rates And Brackets Tax Foundation

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

North Carolina Restaurant Adding 20 Fair Wage Service Fee To Every Bill Wric Abc 8news

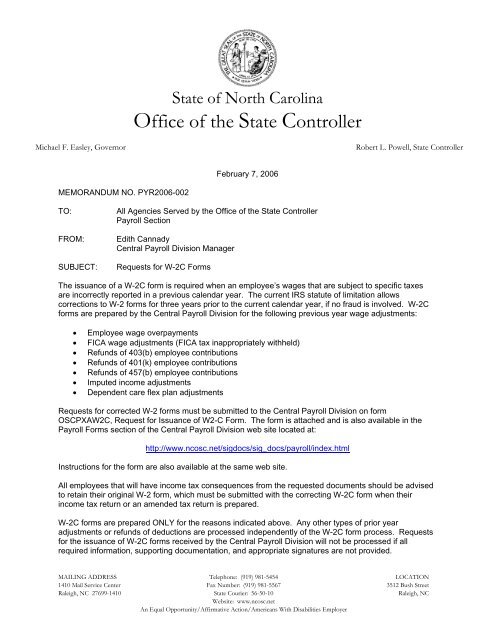

Requests For W 2c Forms North Carolina Office Of The State

State Income Taxes Highest Lowest Where They Aren T Collected

/cloudfront-us-east-1.images.arcpublishing.com/gray/KSVEQPXMGBAJTH5QE54CSGNE4Q.jpg)

Proposed Nc Senate Budget Provides Salary Increases For State Workers Tax Cuts Wage Increase For Many

.jpg)